Originally Posted by

pacfan

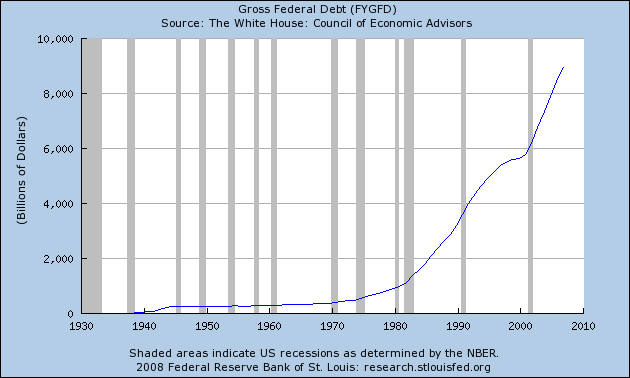

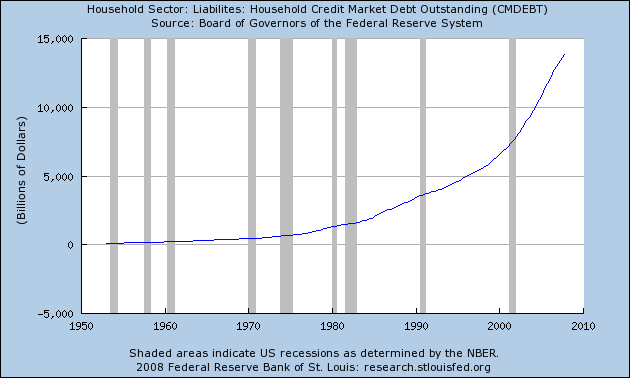

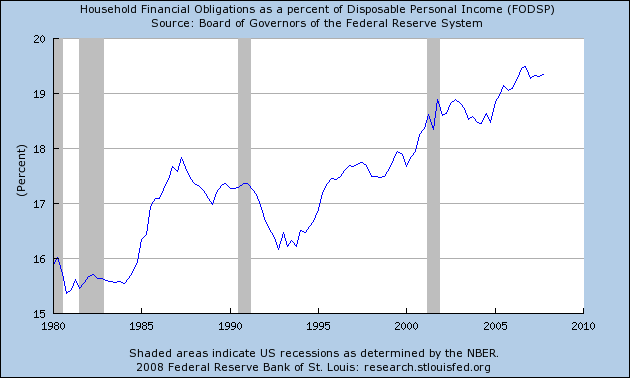

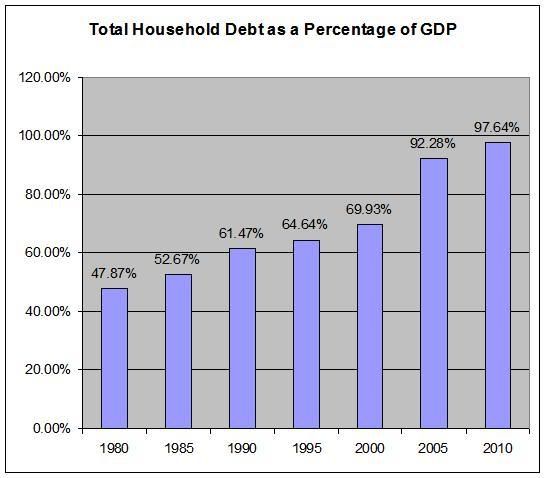

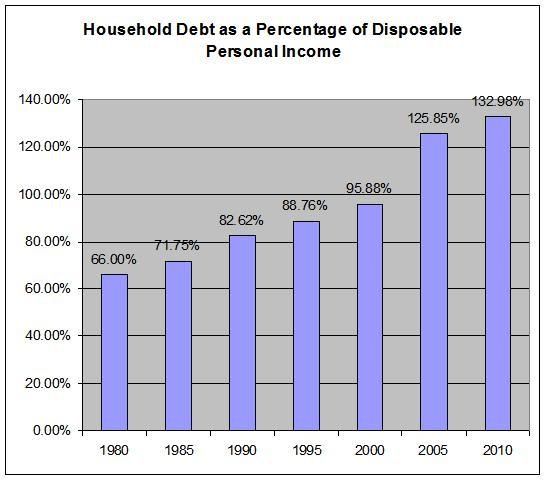

Ooogh. We not only have a stock bubble but also a debt bubble, part of which already burst. National (public) debt is always manageable but the level of those personal household debt is somewhat alarming, especially the increase in percentage relative to the disposable income. But let me tell you that debts themselves are not necessarily bad things as long as they are manageable. You can keep on borrowing and borrowing without problem as long as you have the capacity to pay the due amounts. But the problem is that any imbalance in the economy may affect that capacity or capability to pay. Now, we are faced with at least two of them, the subprime crisis and the high oil price. IMO, among the three of them, the debt crisis, high oil price and the stock market, one gotta give. So the way I see it, if the subprime debt crisis and the high oil price persists, the stock market, which is the barometer of economic health, will be increasingly vulnerable. But, good for us, even if it falls it'll probably be a soft landing like a domino tipped with short one-ended track. But - a big but - on the other hand, it is not entirely impossible that the domino could be a long, multi-ended tracks, which once tipped could have immense impact on the economy. I have to say that I'm not about to press the panic button, but still, it won't hurt to be prepared for the worst. So what I'm trying to impress upon you guys here is that you should at least be prepared for the worst, mentally and emotionally - there is nothing to lose. Though it's easy to exagerrate the effects of economic decline, the worst that can happen is that there will be more business and personal bankrupcies, more lost jobs, less or even negative economic growth, which translates as lesser overall wealth and declining values of your assets (properties) and earnings. Can you live with that? Of course you can. At least you guys in the developed world are still lucky because you probably won't go hungry, unlike the rest of the world.

Thanks:

Thanks:  Likes:

Likes:  Dislikes:

Dislikes:

Reply With Quote

Reply With Quote

What I'm more concerned is the increasing price of fuel.

What I'm more concerned is the increasing price of fuel. It's very alarming.

It's very alarming.

Bookmarks