Ah, optimism. The human part of the equation, and therefore probably the most difficult to quantify and predict. If only the people would behave, do what the gov't tells them, then the job of the economic policy makers would be so much easier.

|

|

Thanks: 0

Thanks: 0

Likes: 0

Likes: 0

Dislikes: 0

Dislikes: 0

Array

Array

Ah, optimism. The human part of the equation, and therefore probably the most difficult to quantify and predict. If only the people would behave, do what the gov't tells them, then the job of the economic policy makers would be so much easier.

Looks like Bernanke is more optimistic than I expected. He says if the Fed and the Obama administration can get the financial and credit markets operating "normally" the recession may end mid-summer. The Dow is up 145 points largely based on this news. I can't help but think that Bernanke is doing little more than confidence damage control here.

Bernanke: economy suffering 'severe contraction' - Yahoo! Finance

Last edited by killersheep; 02-24-2009 at 05:04 PM.

For every story told that divides us, I believe there are a thousand untold that unite us.

Array

Array

You know if we had regulated corporate culture one iota for the last 8 years,we wouldnt be in this freaking mess.

Array

Array

Our gluttony & excess is catching up fast.Alot of it is personal fiscal responsibility,prioritizing needs over wants.Its tough all over right now.Daily directions to"keep payroll down",shave hours and such.Getting into dicey territory when I start considering who can 'take the hit' best and still sustain daily needs.Sometimes its difficult to weigh the personal aspects over buisness,but it is a must.you want to put your head in the sand somedays.

Array

Array

It all comes down to a quick strike to show the shareholders rather then sustainable growth. These idiots,both stockholders and CEO's,were worried about quick gain over something that will last. They walk with a good chunk of all of our money,and the economy goes to shit.As long as the "Captains of Industry" are viewing money as a way of keeping score,then viewing it in terms of need and performance,we're going to end up with this kind of mess.

Couple that with a corporate friendly White House who gutted regulation every single chance they got,and you have a serious bitches brew.

The regulatory laws they gutted,had gotten passed for a reason. Because the chuckleheads who screwed up the economy this time,had fathers who screwed it up last time,so we werent exactly taking them on faith.

As a nation,we have very bad long term memory

Array

Array

I hear ya man.I dont own stock at this moment.Right now I'm trying to figure out how to let a single mother 'go' who has been nothing but a loyal quality worker and a good person,by weeks end.Morally,I can not.But its not about me,the bigger picture rules the day.

Array

Array

Its even hitting boxing,the purses have shrunk,and it puts me in a situation where I have to make moral decisions.

I had to pass on a matchmakers fee yesterday,when I found out someone was offering the kid more money for a non title fight then I was offering for a title fight. I know what he does for a living,he needs the money more then he needs a low level belt,so I told his manager to take the other fight.

Array

Array

He's absolutely full of it. He's shitting himself too. The banking system is collapsing, every major US bank is bankrupt and nobody at the Fed or the treasury knows what to do so they're coming out with increasingly ridiculous statements. A couple of days ago they were telling us the banks were well capitalised. That's another quote I've got tucked away for future refernce. Then yesterday they told us that they're going to magically create capital by some process nobody understands. Now they're telling us the recession is almost over. If there's a miracle and everything goes to plan, maybe. But the plan keeps changing regularly and now nobody even understands it.

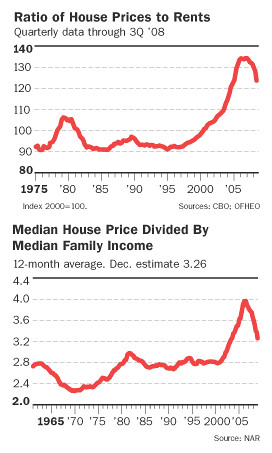

Right now it looks like they're rearranging the deckchairs on the Titanic every week or three and hoping that the problem will go away, roughly approximating what Japan did in their bust, something that xcreated a decade of stagnation. Provided it doesn't disintegrate entirely due to forthcoming events and we still have one on an ongoing basis, the financial system won't even begin to recover until house prices bottom out and we can start getting a clue to how bad the mess is. Same for the economy. That may take some time as the graph shows. Even when prices hit the old average/median they probably will overshoot due to the massive stock of empty/unsold housing, now at an alltime high. And then there's the general economic situation getting worse, foreclosures increasing, etc. So they could keep dropping a while yet.

Array

Array

Feb. 25 (Bloomberg) -- Japan’s exports plunged 45.7 percent in January, resulting in a record trade deficit, as recessions in the U.S. and Europe smothered demand for the country’s cars and electronics...........

“The drop in exports is unbelievably bad,” said Yasuhide Yajima, a senior economist at NLI Research Institute in Tokyo. “The pressure on companies to cut jobs and investment is rising and that will make the recession deep and protracted.” ...........

Japan is the world's second-biggest economy. That's the everyday economy bit. Here's the financial system bit :

The Bank of Japan last week said it will buy corporate bonds for the first time, widening its asset-purchase program to prevent a shortage of credit from deepening the recession. Governor Masaaki Shirakawa and his colleagues lowered the bank’s overnight lending rate to 0.1 percent in December.

The world's major central banks used to have nice clean balance sheets, just containing government bonds. Now they're starting to get cluttered up with all kinds of rubbish, low grade crap and corporate stuff. They have to buy the corporate stuff because corporations can't roll over their debt to commercial (bankrupt) banks and so the central banks are the lender of last resort, keeping the corpoations from shutting down large chunks or all of themselves. Balance sheets of major economies' central banks are now looking like those of third world countries and banana republics. This is not good at all.

http://www.bloomberg.com/apps/news?p...Eqw&refer=home

Array

Array

The Chairman of the Fed actually said this today in congressional testimony :

"We're not completely in the dark. We're working along a program that has been applied in various contexts, obviously not in identical contexts, in other countries in other times. So we're not making it up, we know broadly speaking what needs to be done."

That's another quote I'll be keeping for future use.

My translation :

We are completely in the dark. The plan changes every few days as we get more and more desperate. We're making it up as we go along.

Here's another good one :

Citigroup and the US Treasury are nearing agreement on a deal that would give the federal government a stake of about 40 per cent in the troubled bank in exchange for bolstering its depleted capital base.

People close to the situation said no agreement had yet been reached and the government had yet to give its approval to the plan proposed by Citi, which stops short of outright nationalisation. But they added that negotiations between Citi's executives and Treasury officials had made progress since the weekend and an announcement could come as early as today or tomorrow.

My translation :

Citi to US Government : For You We Make Special Deal.

Feb 26.

UK - Nationwide HPI

Actual-1.80% |Forecast

-1.20% |Previous

-1.30%

The Nationwide HPI is an economic indicator that measures both the quantity and price statistics regarding the sales of newly built and existing homes..

-------------------------------------------------------------------

USA - Core durable goods orders

Actual-2.50% |Forecast

-2.10% |Previous

-3.90%

Derivative of Durable Goods Orders that omits the Transportation components. Orders for aircraft occur in periodic burst and can severely distort the underlying trend, so Currency traders tend to focus more on this indicator than the overall Durable Goods Orders.

--------------------------------------------------------------------

USA - New homes sales

Actual- |Forecast

325.00K |Previous

331.00K

Determines the annualized amount of new residential buildings that were sold during the last month. A rising trend has a positive effect on the nation's currency as the housing market is a leading gauge for the overall economy. New housing activity creates an economic ripple effect as home owners buy goods such as appliances and furniture for their homes, and builders buy raw materials and hire more employees to meet demand. A high level of housing activity signals that the construction industry is healthy and that consumers have the capital to make large investments.

Last edited by killersheep; 02-26-2009 at 01:10 PM.

For every story told that divides us, I believe there are a thousand untold that unite us.

Array

Array

More record-breaking data today. Record low housing sales, record high housing stock, recoed number of consecutive months that durable goods orders fell. Coming tonight some quote art, featuring a quote by The Infallible One.

There are currently 1 users browsing this thread. (0 members and 1 guests)

Bookmarks