Originally Posted by

Gandalf

Kilrkland, I am beginning to see why Lyle uses such horrible language to describe you. You contort and twist and abuse, whilst at the same time fail to acknowledge all the obvious and real examples of inflation in the economy. House prices, energy bills, public transportation costs, stock market etc all display real and obvious inflationary pressures. Yet for some reason you want to tell me that I have only just learned that banking is a fraud, I'm an idiot, and that there is 'No inflation, nothing to see here because I am just great'. Talk about deflection and an inability to talk about inflation. You are a very rude man and I have no reason to converse with you. You should learn an honest trade and act with grace.

I'm not contorting or twisting anything. I'm simply asking you to square your belief that various economic numbers are being manipulated and altered with you claiming to agree with the beliefs of an economist who clearly accepts that these economic numbers are accurate. You can't make both claims at once.

And you can't come up with a coherent reply because it's impossible to do. You either believe that the numbers are bollocks or you don't. And because you can't come up with a reply you're resorting to Lyle-style word salad posts or claiming that I'm mean and unpleasant and an absolute rotter.

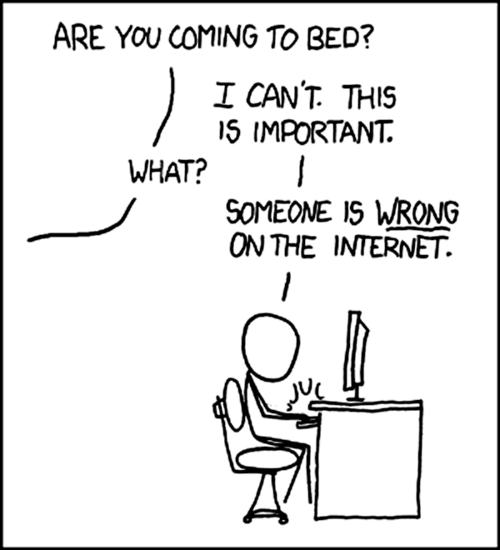

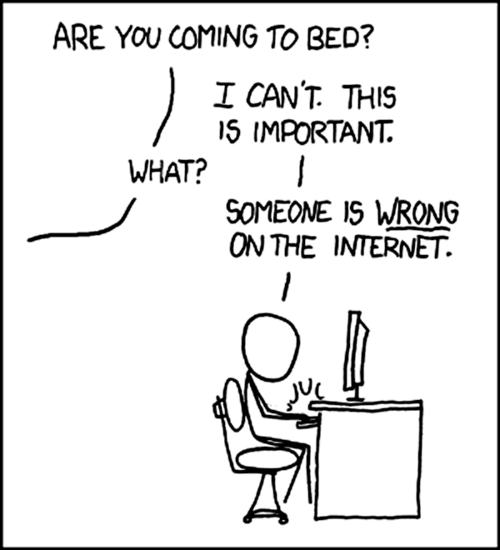

What I am is annoyed when people are wrong about things so I waste my time replying to them, even when they don't have a fucking clue what they're talking about.

Thanks:

Thanks:  Likes:

Likes:  Dislikes:

Dislikes:

Reply With Quote

Reply With Quote

Bookmarks