Funding

The Tax Foundation is funded partially by private donations from members, but is primarily funded by corporate donations, with limited foundation funding from the Koch Foundation, Earhart Foundation, etc.

Tax Foundation - SourceWatch

It's unsurprising that a bunch of corporations should want lower corporation tax. However America already has the lowest real rates of corporation tax in the world. Half of all corporations pay no tax, some even get rebates. They can also defer taxes for up to 30 years. I'm sure you're aware that money invested for thirty years plus inflation means that when they do pay the tax it's less than 3% of how much they should have paid 30 years ago.

Here's a quick breakdown of US corporation tax for you :

Today, the Government Accountability Office (GAO) released a study on taxes paid by corporations. In what Sen. Byron L. Dorgan (D-ND) mildly called "a shocking indictment of the current tax system," the GAO found that about two-thirds of corporations operating in the US did not pay taxes annually from 1998 to 2005.

Now most corporations in America are start-ups or small, mom and pop operations that have adopted a corporate form to lower their tax rates. And a greater percentage of large corporations do pay some taxes. But in 2005, with corporate profits reaching new heights as a percentage of national income, the GAO found that over one-fourth -- 28% of large corporations paid no taxes. (It defined large corporations as those with assets of at least $250 million dollars or gross receipts of at least $50 million dollars.) They can tell you how to make $50 million dollars and not pay taxes.

Not surprisingly, the income collected from corporations has been declining as a percentage of GDP, with the burden transferred to your income and payroll taxes. According to a study by the Treasury Department, from 2000-2006, an average of 2.2% of GDP was collected in corporate taxes. This compares to an average of 3.4% in other industrial countries. The nonpartisan Congressional Budget Office projects that, under current law, corporate revenues will decline to 1.9% of GDP by 2017, the lowest rate in the industrialised world.

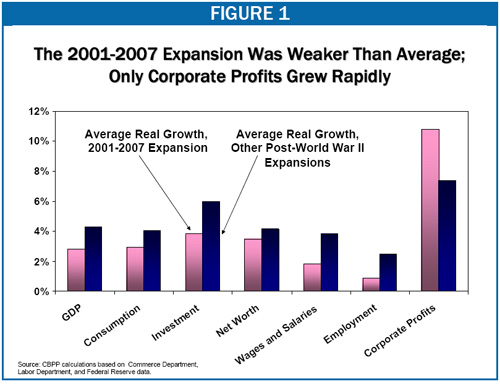

Meanwhile US corporations are the only people seeing any growth inearnings when the economy is growing. Workers certainly aren't :

So again you've got people pushing your buttons on cultural issues to make you support huge tax cuts for corporations and billionaires, in opposition to your own economic interests.

And because since Reagan so much of the tax burden has already been transferred from these guys to Joe Sixpack we're in crisis. The bursting of the housing bubble caused the current crisis, but the underlying problem began much earlier -- in the late 1970s, when median U.S. incomes began to stall. Because wages got hit then by the double-whammy of global competition and new technologies, the typical American family was able to maintain its living standard only if women went into the workforce in larger numbers, and later, only if everyone worked longer hours.When even these coping mechanisms were exhausted, families went into debt -- a strategy that was viable as long as home values continued to rise. But when the housing bubble burst, families were no longer able to easily refinance and take out home-equity loans. The result: Americans no longer have the money to keep consuming. When you consider that consumers make up 70 percent of the economy, the magnitude of the problem becomes apparent.

What happened to the money? Since the late 1970s, a greater and greater share of national income has gone to people at the top of the earnings ladder. As late as 1976, the richest 1 percent of the country took home about 9 percent of the total national income. By 2006, they were pocketing more than 20 percent.

But the rich don't spend as much of their income as the middle class and the poor do -- after all, being rich means that you already have most of what you need. That's why the concentration of income at the top can lead to a big shortfall in overall demand and send the economy into a tailspin. (It's not coincidental that 1928 was the last time that the top 1 percent took home more than 20 percent of the nation's income.)

To get out of this we're going to have to have massive redistribution of wealth. The best way to start would be to get corporations and the wealthy to pay their fair share of taxes. let's look at the US tax situation right now. The wonder of google gives me exaclty what I'm looking for. If you only read one article this year Lyle read this one. It's full of facts and evidence but don't let that put you off :

Fiscal Therapy | Mother Jones

|

|

Thanks:

Thanks:  Likes:

Likes:  Dislikes:

Dislikes:

Reply With Quote

Reply With Quote

Bookmarks