He's absolutely full of it. He's shitting himself too. The banking system is collapsing, every major US bank is bankrupt and nobody at the Fed or the treasury knows what to do so they're coming out with increasingly ridiculous statements. A couple of days ago they were telling us the banks were well capitalised. That's another quote I've got tucked away for future refernce. Then yesterday they told us that they're going to magically create capital by some process nobody understands. Now they're telling us the recession is almost over. If there's a miracle and everything goes to plan, maybe. But the plan keeps changing regularly and now nobody even understands it.

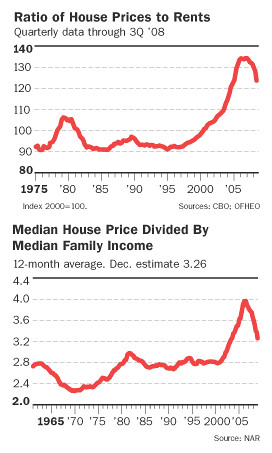

Right now it looks like they're rearranging the deckchairs on the Titanic every week or three and hoping that the problem will go away, roughly approximating what Japan did in their bust, something that xcreated a decade of stagnation. Provided it doesn't disintegrate entirely due to forthcoming events and we still have one on an ongoing basis, the financial system won't even begin to recover until house prices bottom out and we can start getting a clue to how bad the mess is. Same for the economy. That may take some time as the graph shows. Even when prices hit the old average/median they probably will overshoot due to the massive stock of empty/unsold housing, now at an alltime high. And then there's the general economic situation getting worse, foreclosures increasing, etc. So they could keep dropping a while yet.

|

|

Thanks:

Thanks:  Likes:

Likes:  Dislikes:

Dislikes:

Reply With Quote

Reply With Quote

Bookmarks