When house prices started to fall and foreclosures started to spike the firms that held this paper realised they had a problem. If a mortgage had already been split into hundreds of pieces and was included in hundreds of different secutities, who had right of ownership on the foreclosed property? Who got paid first and last from whatever the house eventually sold for? With house prices in freefall, putting a value on how much the securities were worth became impossible. Nobody would pay what they were worth and the only stuff traded recently has been sold for between 5-20 cents on the dollar. So firms have huge losses and massive debts that they used these securities to guarantee and even leverage. Now nobody knows which banks are solvent and which aren't so nobody is lending to each other and nobody is trading. Firms that own a ton of this are being short-sold out of existence by speculators. That's where we are right now.

Here's a picture and a graph that explain what happened nicely. Here are a bunch of banking lobbyists that in a fox/henhouse move Bush put in charge of US financial regulatory agencies taking a chainsaw and tree shears to a stack of banking regulations, "cutting red tape" so that the free market can make profits soar :

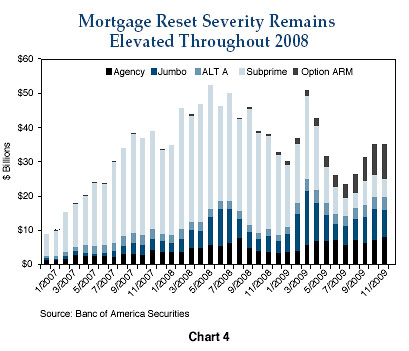

Now here's one that shows exactly how the subprime metdown started all this. All subprime loand had a teaser rate that lasted for typically 2-3 years. This rate meant that the first 2-3 years' payments were like rent money or even less. But after 2-3 years the interest rate on the mortgage resets and the payments balloon. So this graph shows how subprime lending went stratospheric after the rate was cut in 2003, and shows the dates this vast quantity of mortgage paper reset its interest rates. You'll see how the huge numbers of resets match exactly the start of the current meltdown. Nothing to do with Jimmy Caret and a 1977 bill which was a major success, but everything to do with the effective end of regulation of the mortgage/commercial banking/securities industries after 2000.

There's a lot of stuff I've forgotten or missed out but this should give you a good overall picture of the reality. You know, what actually happened. I'd be interested to hear your reply to this :

It's a shame it doesn't show 2006. The 2006 numbers were small fractions of even the January 2007 numbers. Anyway you can see all these bad loans were made from 2004 onwards.

And back to your post again, the final point you made about Obama creating TARP. I agree with you about this apart from the FACT about Obama creating it. It wasn't Obama. Can you guess who it was?

Troubled Asset Relief Program - Wikipedia, the free encyclopedia

|

|

Thanks:

Thanks:  Likes:

Likes:  Dislikes:

Dislikes:

Reply With Quote

Reply With Quote

Bookmarks